March 2020

COMMUNITY ANNOUNCEMENT & PRESS RELEASE

We at Bowen College want you to know we are thinking about you and ways to help our community and

the many challenges each of you might be facing during this time. We have all had to adjust our lives,

schedules, and perspectives over the last few weeks. We want to assure you we are doing everything we can

to support our workers and our students. We are in this together and we apologize for any delays in student

services as we navigate this difficult time.

As Bowen Therapists, the impact of COVID-19 on our clinics and businesses can feel daunting. We are joined

by the 80% of the Canadian population who also work in the service industry and who are experiencing a

loss to their livelihood.

We have put together the following information for practitioners in hopes it will help you prepare financially

for the coming months. Further updates will come as it is released to the public. We are in this together and

we will get through this together.

Notable Topics & Dates

- Canada Emergency Response Benefit (CERB) offering $2000/month for

4 months. Applications completed via online through the government

website and is set for the first week of April, 2020 - Automatic deferral for anyone with a Student Loan debt for a total of 6-

months. No applications necessary - EI application waives the 1-week waiting period for sickness benefits

- HST/GST tax payments have been deferred until August 31, 2020

- Individual Tax returns are differed until June 1, 2020

- A 75% wage subsidy for qualifying businesses, for up to 3 months,

retroactive to March 15, 2020 - NEW Canada Emergency Business Account will provide up to $25 billion

to eligible financial institutions so they can provide interest-free loans to

small businesses - How to Apply for EI LInks and details

- Links for the Comprehensive Preparedness Guide for businesses

provided by Canadian Chamber of Commerce and The Canadian

Federation of Independent Business - Increase in Canada Child Benefit and will be delivered as part of the

scheduled CCB payment in May, 2020 - Premiums for all individually owned life and health insurance can be

deferred for up to 90 days without a loss of coverage (stipulations apply) - Links for Mortgage support- payment deferral, loan re-amortization,

capitalization of outstanding interest arrears and other eligible expenses

and special payment arrangements - LEARN & SHARE the WHO open learning website with your community

about what we know about COVID-19 for those experiencing language

barriers

EXPERIENCING A LOSS OF WAGES?

IF YOU ARE A SOLE PROPRIETOR IN PRACTICE THIS IS FOR YOU!

The government of Canada has introduced the Canada Emergency Response Benefit (CERB) to support workers and help businesses keep their employees, providing $2000 a month for up to 4-months for workers and entrepreneurs who are not receiving a pay-cheque as a result of COVID-19.

- The application cycle has yet to begin but is expected to commence by the start of April. Payments are expected to be available in May 2020.· The CERB covers Canadians who have lost their job, are sick, quarantined, or taking care of someone sick with COVID-19, as well as working parents who must stay home without pay to care for children who are sick or at home because of school or daycare closures. The CERB would apply to wage earners, as well as contract workers and self-employed individuals who would not otherwise be eligible for

Employment Insurance (EI). This includes those who are still employed but not receiving income because of disruptions to their work situations due to COVID-19. This means if you are a practitioner and consider yourself a self employed you are eligible to apply for this benefit during this difficult time. - People with student loan debt will be automatically deferred in their monthly payments for 6-months. There is no application to fill, this is automatically enforced by the Federal government.

- The Canadian government will be waiving the mandatory one-week waiting period for Employment Insurance (EI) sickness benefits while income support for those who are not eligible for EI sickness benefits is also being explored.

The government of Canada has introduced the Canada Emergency Response Benefit (CERB) to support workers and help businesses keep their employees, providing $2000 a month for up to 4-months for workers and entrepreneurs who are not receiving a pay-cheque as a result of COVID-19.

How to Apply for EI benefits:

Visit Employment and Social Development Canada (ESDC) and complete the following steps as outlined. To begin your application please go HERE

The ESDC toll-free phone number is 1-833-381-2725. The government advises those with COVID-19 symptoms to remain at home for the safety of yourself and those around you.

Please note the overwhelming surge of applications has created website delays please be sure to try again at variable times should you need this assistance.

Additional Government support is made available to your business and workers. Contact: 1-800-OCanada (1-800-622-6232)

IS YOUR CLINIC LOSING REVENUE?

THE GOVERNMENT OF CANADA HAS INTRODUCED THE

FOLLOWING FOR ITS SERVICE BASED BUSINESSES

- A deferral of Goods and Services Tax/Harmonized Sales Tax (GST/HST) until June. Please note the June date was referenced on the Prime Minister site but stated the deferral date of August 31, 2020, on the government site. We will keep you updated on the following contradictions as news becomes clearer and public announcements are made. This is automatic and business owners can implement this to help with immediate cash flow.

- A 75% wage subsidy for qualifying businesses, for up to 3 months,

retroactive to March 15, 2020. This will allow businesses to keep running and retain their payroll. More details on eligibility criteria will start with the impact of COVID-19 on sales and will be shared before the end of March 2020. ·Learn More HERE - The launch of the NEW Canada Emergency Business Account will provide up to $25 billion to eligible financial institutions so they can provide interest-free loans to small businesses. This means $40,000 is given to businesses with payrolls of less than $1 million. A quarter of this loan (up to $10,000) is eligible for complete forgiveness. These loans and guaranteed and funded by the Government of Canada and will ensure that small businesses have access to the capital they need, at zero percent interest rate

- Launch of the NEW Small and Medium-sized Enterprise Loan and

Guarantee program that will enable $40 billion in lending, supported

through Export Development Canada and Business Development Bank for guaranteed loans when small businesses go to their financial institutions to help weather the impacts of COVID-19. This is specifically designed to help small and medium-sized companies with operational cash flow requirements. Please note there is no definition for what qualifies as a small or medium business. Learn More HERE

ARE YOU RENTING AND IMPACTED BY THE COVID-19 CRISIS?

CANCEL RENT DAY

BC HOUSING CRISIS ACTION

The BC Housing Crisis Action has started a petition for anyone in the province of British Columbia to cancel rent day. If you are renting and impacted by the COVID-19 crisis or know someone struggling at this time due to a loss of wage, have your voice heard in these unprecedented times; let your premier and MLA know what you need.

By signing this petition We are calling on BC and the Federal government to:

- Cancel Rent Day in BC from April of 2020 until the end of the COVID-19 crisis Put paperwork on Landlords and Not Tenants

- Create a Provincial Landlord Registry

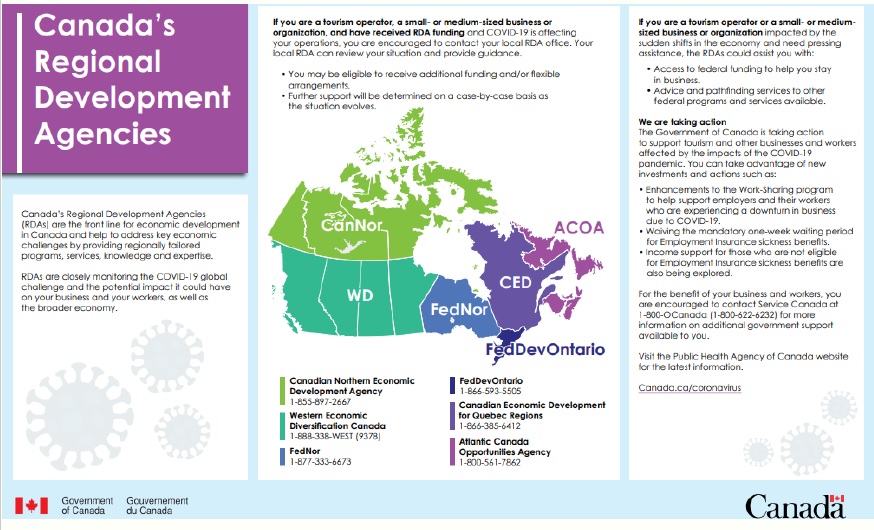

Canada Regional Development Agencies (RDAs) are the front line for economic development in Canada and help to address key economic challenges. If you are a small or medium-sized business or organization and have received RDA funding and COVID-19 is affecting your operations, you are encouraged to contact your local RDA office. You may be eligible to receive additional funding and/or flexible arrangements.·

If you are a small or medium business or organization impacted by the sudden shifts in the economy and need pressing assistance, the RDAs will assist you with:·

- Access to federal funding to help you stay in business

- Advice and path finding services to other federal programs and services available

Download the pdf HERE to find your RDA provincial contact number or see the map below:

The Canadian Chamber of Commerce and The Canadian Federation of Independent Business has developed a comprehensive preparedness guide for businesses in the face of COVID-19 to help businesses through these difficult times. Please follow the link HERE to read more.

TAXES & FINANCIAL PLANNING

If you are have a financial advisor I encourage you to make the time to speak directly to them about the status of your investments. Many advisors are now taking virtual or phone meetings. If you are with Sun Life Investments they have implemented the Premium Relief Program which states the following:

Premiums for all individually owned life and health insurance can be deferred for up to 90 days without a loss of coverage. Clients are asked to call the customer service center (currently the individuals are all working remotely), 877-786-5433 to make arrangements. This is not a loan and will not attract interest but rather a deferral with an automatic call back feature to resume premiums at the end of 90 days. All life and health insurance qualifies with the exception of personal health (extended health).

Clients with RBC individually owned disability insurance should call the customer service centre 888 604 3434

Group Benefits Update

Sun Life has developed an initiative with the finance minister Bill Morneau on the group side to ensure Canadians maintain their group benefits regardless of employment status.

The Bank of Canada announced a further interest rate reduction of .25 basis points with a new key interest rate of .25%. This is directly targeted to Canadians to allow for affordable borrowing from their lenders to get through this crisis.

Support for Individuals & Families

The following has been implemented by the Canadian Government to support you:

- Increasing the Canada Child Benefit by providing an extra $300 per child through the Canada Child Benefit (CCB) for 2019-20. This will mean approx. $550 more for the average family. It will be delivered as part of the scheduled CCB payment in May. Those who already receive the Canada Child Benefit do not need to re-apply.

Extra Time to File Income Tax Returns

The filing date for 2019 individual tax returns are deferred until June 1, 2020. All new income tax balances due, or instalments to be deferred until after August 31, 2020 without incurring interest or penalties.

Mortgage Support

Canadian banks have committed to work with their customers on a case -by-case basis to find solutions to help them manage hardships caused by COVID-19. Canadians who are impacted by COVID-19 and experiencing financial hardship as a result should contact their financial institution regarding flexibility for a mortgage deferral. The Canadian Mortgage and Housing Corporation and other mortgage insurers offer tools to lenders that can assist homeowners who may be experiencing financial difficulty. This includes payment deferral, loan re-amortization, capitalization of outstanding interest arrears and other eligible expenses and special payment arrangements.

To Read COVID-19: Managing Financial Health in Challenging Times please follow the link HERE

Looking to Help Anyway You Can?

As health professionals it is hard to stand by and watch the devastation of COVID-19 on the world today without being able to do something definitive to help. We encourage you to continue serving your communities in anyway you can during this time. It might be as simple as educating those around you on the importance of washing your hands and practicing physical distancing.

We have heard from community members offering their services via zoom to give support and treatments long distance…or opening up zoom chats to provide connection and community…This is amazing and the heart of WHY we have become health professionals. To continue using our imaginations on how we will serve others will

make a difference in how much we can to learn from this experience. The following links are for educational purposes. Some are designed to be shared in communities where language barriers might be impacting people.

Visit your Facebook Page and LIKE the Healthy Canadians Page to stay up to date with the latest news

Visit the Public Health Agency of Canada: Canada.ca/coronavirus

To find out more about resources for your Small Business during COVID-19:

https://www.cfib-fcei.ca/en/small-business-resources-dealing-covid-19

Additional Resources:

https://pm.gc.ca/en/news/news-releases/2020/03/27/prime-minister-announces-support-small-businesses-facingimpacts